Syed Samir Hassan, founder and CEO of CypherFace, leads a company that is transforming how North American merchants authorize payments. With more than two decades of experience in artificial intelligence, augmented reality, and financial technology, Hassan built a system that empowers users to make payments using facial biometric verification instead of cards.

Encrypted Facial Payments With Measurable Results

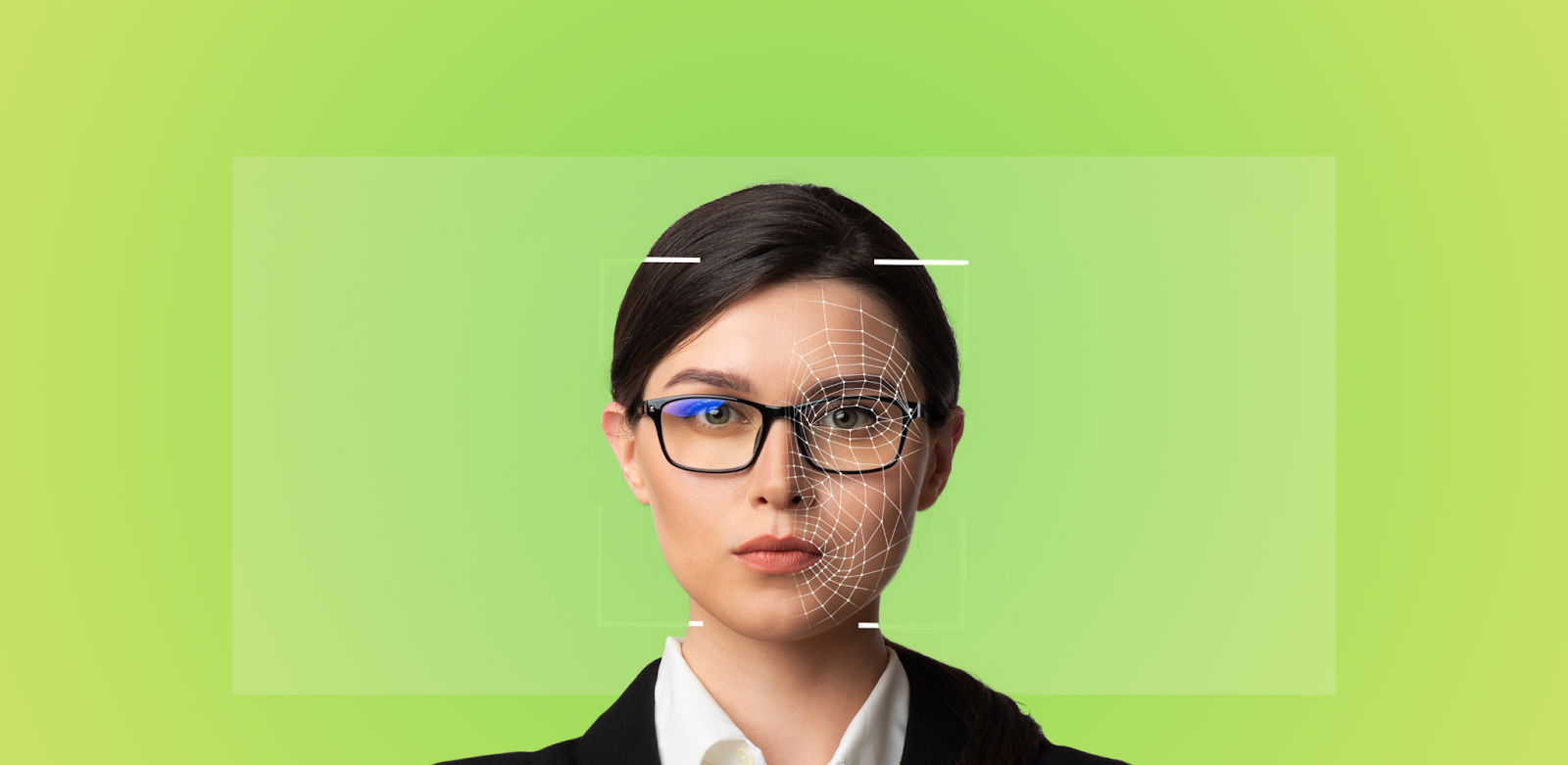

CypherFace authorizes transactions through encrypted facial data. Internal testing shows the system eliminates 99.7 percent of payment fraud and reduces merchant processing fees by 40 percent through direct bank transfers.

The process begins with user enrollment, which includes biometric capture and account verification. Customers check their balance in real time and earn instant discounts by selecting direct bank transfers. CypherFace’s processor-agnostic gateway moves funds quickly and supports a wide range of banks and merchant types without locking anyone into a single provider.

CypherFace includes anti-spoofing protections and liveness detection to secure every transaction. These features prevent the use of photos or digital replicas while maintaining the system’s speed and accuracy.

Advancing Adoption Through Simplicity And Trust

Biometric payments continue to grow across North America, and CypherFace supports this shift by addressing merchant concerns about fraud and processing costs. Businesses using the system report reduced chargebacks, lower interchange fees, and smoother settlement processes.

“Your face is secure,” Hassan said. “We created this platform to eliminate fraud while preserving a seamless checkout experience.”

CypherFace promotes user adoption through transparent opt-in terms and practical incentives such as discounts and reduced fees. The system protects privacy by converting facial scans into encrypted vectors, ensuring strong security tied to user credentials.

Scalable Growth Strategy With Global Readiness

CypherFace plans to expand into Canada and Mexico over the next year. The team is finalizing regional compliance efforts and onboarding partners in hospitality, transportation, and other high-volume sectors. The company expects to launch three regional pilots before the end of the year.

Global companies like PopID and SmilePay also operate in facial biometric payments. However, CypherFace delivers a processor-agnostic system that enables instant merchant settlements and applies liveness detection at every interaction point.

“Fraud doesn’t recognize borders,” Hassan said. “We built CypherFace for businesses that demand total control, real-time security, and consistent performance—everywhere they operate.”

Analysts expect facial biometric payments to process trillions of dollars in transactions by the 2030s. CypherFace plans to capture a meaningful share of that growth by offering enterprises worldwide secure, cost-efficient, and hardware-independent solutions.