In what could become one of the most transformative deals in modern media history, Paramount Global is reportedly preparing a bid to acquire Warner Bros. Discovery (WBD), according to CNBC. The move, if finalized, would unite two of the industry’s most prominent legacy media and sports powerhouses under one roof and could reshape the competitive landscape for streaming, sports, and entertainment.

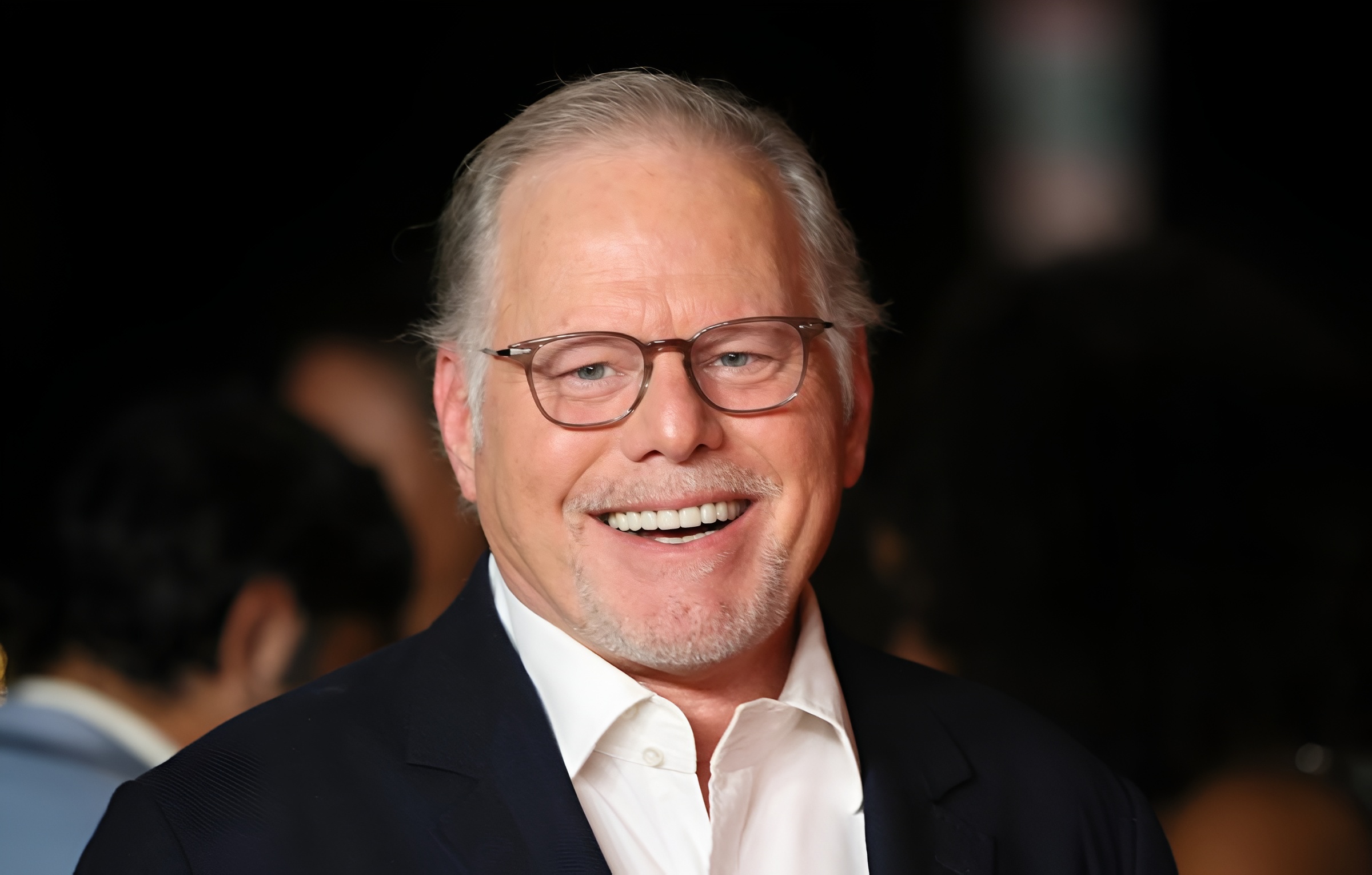

For Warner Bros. Discovery CEO David Zaslav and his board, the looming question is whether to accept Paramount’s anticipated bid or to move forward with WBD’s internal restructuring plans. The company has been preparing to split into two separate entities: Discovery Global, a cable-network-driven company, and a Warner Bros. studio and streaming division, which would retain the marquee brands HBO, Warner Bros. Pictures, and Max.

Sources familiar with the matter told CNBC that Zaslav believes the studios and streaming assets could attract significant interest from tech giants such as Apple, Amazon, Netflix, or Comcast, potentially sparking a bidding war that would drive WBD’s valuation far higher than Paramount’s offer.

Warner Bros. Discovery currently trades around $19 per share, translating to a market capitalization of approximately $47 billion. Adding roughly $30 billion in net debt and factoring in a potential takeover premium, the total transaction value could approach $90 billion.

Paramount’s potential offer is reportedly in the range of $22 to $24 per share, but insiders suggest Zaslav will push for more. The deal would be financed with support from Larry Ellison, the billionaire founder of Oracle and the world’s second-richest person, who has been backing Paramount’s recent expansion through its merger with Skydance Media.

A combined Paramount WBD entity would immediately emerge as a formidable sports and entertainment giant. The merger would unite TNT Sports and CBS Sports, consolidating coverage of premier events such as the NFL, MLB, NHL, NCAA March Madness, college football, UFC, and NASCAR.

Although WBD recently lost the NBA’s broadcast rights for the upcoming season, the combined company would still rival NBCUniversal’s sports portfolio and inch closer to ESPN’s dominance.

“It’s exciting for us because it’s showing one of our big partners who is attempting to transform itself right before our eyes,” said NFL Commissioner Roger Goodell, in an exclusive interview. “I think they’re recognizing the value of content.”

Paramount’s motivation to move quickly is partly shaped by lessons from its Skydance merger, which was delayed by regulatory holdups. Sources told CNBC the FCC’s prolonged approval process which extended until after a “60 Minutes” settlement involving former President Donald Trump contributed to erosion in Paramount’s asset values.

The company’s linear television business has been in steady decline, and the delay left senior executives unable to make long-term strategic decisions. Some, including former co-CEOs Chris McCarthy and Brian Robbins, have since exited the company. Paramount’s upcoming third-quarter earnings in November are expected to reveal the extent of that value loss.

Still, analysts note that a deal with WBD could reset the narrative entirely. With a strengthened balance sheet, expanded streaming catalog, and massive sports rights portfolio, Paramount could reemerge as a key player in global entertainment.

The potential merger has raised alarm bells across the industry particularly at Comcast’s NBCUniversal, which already faces pressure from larger rivals. If Paramount successfully acquires WBD, NBCUniversal and its streaming platform Peacock could become even more subscale in comparison.

Such a scenario could make NBCUniversal a less attractive destination for major sports leagues or entertainment talent seeking broader reach. “Would a sports league want to put programming on Peacock or a combined Paramount+ and HBO Max?” one analyst asked. “The latter would have far more viewers.”

Speculation also persists over whether Comcast CEO Brian Roberts and incoming co-CEO Mike Cavanagh might consider a counteroffer for WBD though such a move would be complicated by NBCUniversal’s ongoing spin-off of its cable networks.

Meanwhile, companies like Netflix, Apple, and Amazon reportedly prefer to stay away from cable-heavy legacy media assets, making Paramount one of the few logical buyers with operational synergies to justify such a deal.

Zaslav has long advocated for further consolidation in the entertainment industry, arguing that scale is essential for survival in the streaming era. The Paramount WBD discussions could mark the beginning of that long-predicted wave.

In a related development, Versant, NBCUniversal’s soon-to-be-spun-off media unit that owns CNBC, is said to be exploring the sale of SportsEngine, its youth sports team management platform. Sources say Versant intends to redeploy proceeds from a sale toward expanding live sports rights and strategic acquisitions in news and finance underscoring how the entire industry is pivoting around live sports and streaming capabilities.

If consummated, a Paramount Warner Bros. Discovery merger would reshape the global media landscape, uniting two iconic entertainment brands, deepening sports offerings, and heightening competition across streaming, advertising, and distribution.

For David Zaslav, David Ellison, and Larry Ellison, the coming months will test not just their strategic resolve, but the limits of what’s possible in a media world racing toward consolidation and digital transformation.