When Farazad Advisory GmbH decided to move its headquarters from London to Zurich in late 2024, it was not responding to a crisis. It was acting on a pattern. Years of observing regulatory divergence, unstable capital flows, and shifting investor expectations had made one thing clear: the old centers of gravity no longer guaranteed stability. What the firm needed was not a trend to follow, but a foundation to build from. Zurich became that foundation.

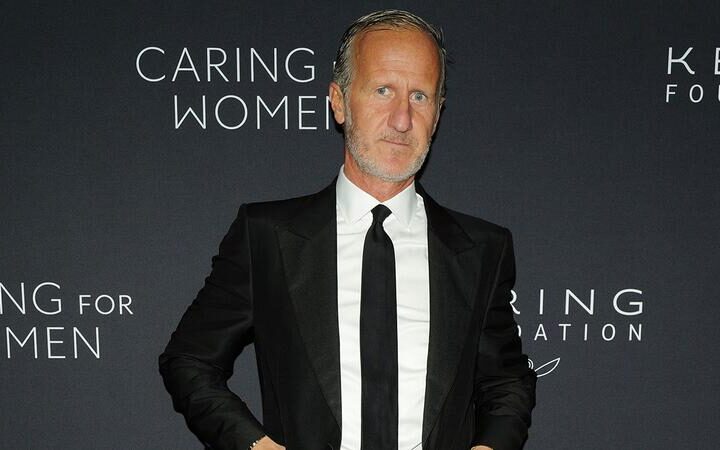

Founded by Korosh Farazad, the advisory firm, which is a subsidiary of Farazad Group had spent more than a decade navigating cross-border capital in real estate, infrastructure, and hospitality. It had grown in London, but London had changed. Regulatory uncertainty after Brexit, inconsistent access to European institutions, and rising operational costs made it harder to execute with precision. At the same time, Farazad Advisory’s global portfolio was expanding. The firm needed a jurisdiction that could support clients from the Gulf, partners from Europe, and transactions built to last.

Why Zurich Was The Right Fit

Zurich offered more than an address. It offered a blueprint. Switzerland’s legal frameworks are built for continuity. The Swiss Financial Market Supervisory Authority enables predictable filings, faster structuring, and easier alignment with institutional investors. Zurich also sits within close reach of Frankfurt, Milan, and Paris, while maintaining direct access to Abu Dhabi and Riyadh. For a firm serving both European and Gulf capital, that geography matters.

NuGreen As A Case Study For Expansion

But the real value came after the move. Within months of setting up in Zurich, Farazad Advisory accelerated one of its most ambitious investments to date: NuGreen Inc., a low-carbon cement company that had spent over 15 years developing a formula to eliminate clinker, the most polluting element in traditional cement. Backed by more than $45 million in research and development, NuGreen’s product combines fly ash and a special mix to match the performance of standard cement with a fraction of the emissions.

Switzerland proved to be the right launchpad. Its updated sustainable finance roadmap in 2024 helped NuGreen establish local partnerships, build credibility with regulators, and connect with infrastructure leaders across the EU. Meanwhile, Farazad Advisory used its strong relations in Dubai and Abu Dhabi to route logistics through tariff-free zones, anchoring NuGreen between two stable trade corridors. Zurich made this dual-market strategy possible. It gave the firm space to grow on both fronts.

A Platform For East-West Investment Discipline

At the same time, Zurich strengthened the firm’s ability to work with Gulf investors. Many of the family offices and sovereign clients Farazad Advisory serves are looking for steady-yield, long-hold assets with minimal exposure to market volatility. Swiss structures allow the firm to design capital stacks that meet European legal standards. These are not theoretical synergies. They show up in real estate joint ventures, hospitality asset repositionings, and infrastructure tranches that meet ethical and institutional criteria alike.

Zurich As A Philosophy, Not Just A Location

Farazad Advisory’s move to Zurich is not a story of escape. It is a story of alignment. The firm did not leave London to simply reduce costs. It stepped into Switzerland to build resilience. Zurich gave it faster execution, deeper regulatory clarity, and better proximity to the investors who think beyond market cycles. NuGreen gave it a proof point. And its continued activity across Europe and the Gulf gives it a direction.

“We moved because our clients need clarity and our work requires precision,” said Farazad. “Zurich gives us both. It is a place where we can make decisions with long timelines and deliver outcomes that hold their shape.”

Farazad Advisory’s pivot is not just geographic. It is philosophical. In a market that often rewards speed, the firm has chosen structure. In a financial system saturated with messaging, it has chosen discipline. And in a world where volatility is no longer episodic but constant, it has chosen to build where resilience is measurable.